income tax rate philippines 2021

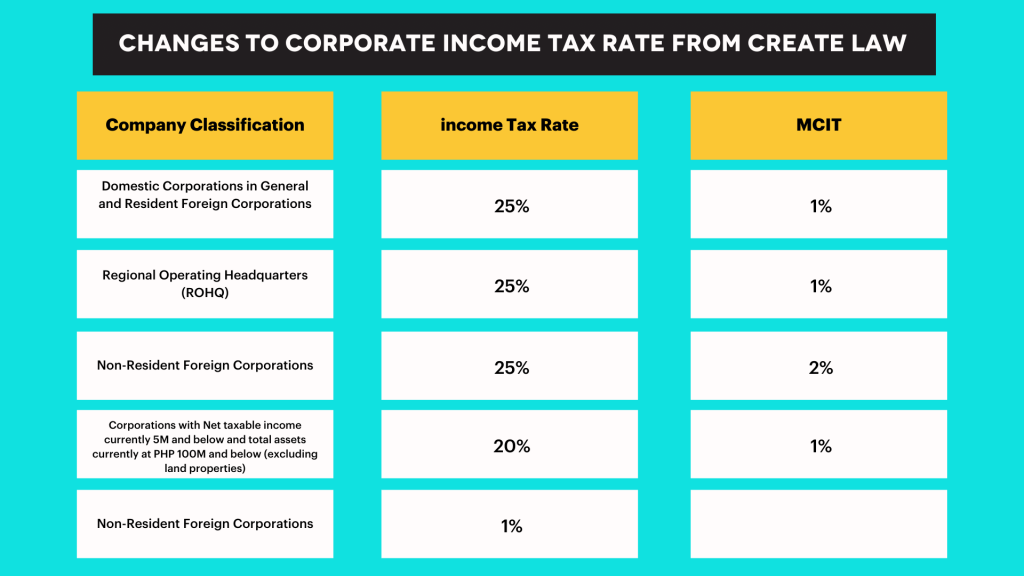

Effective 1 July 2020 until 30 June 2023 the minimum CIT rate is reduced from. The CREATE Law 2021 does not suspend the.

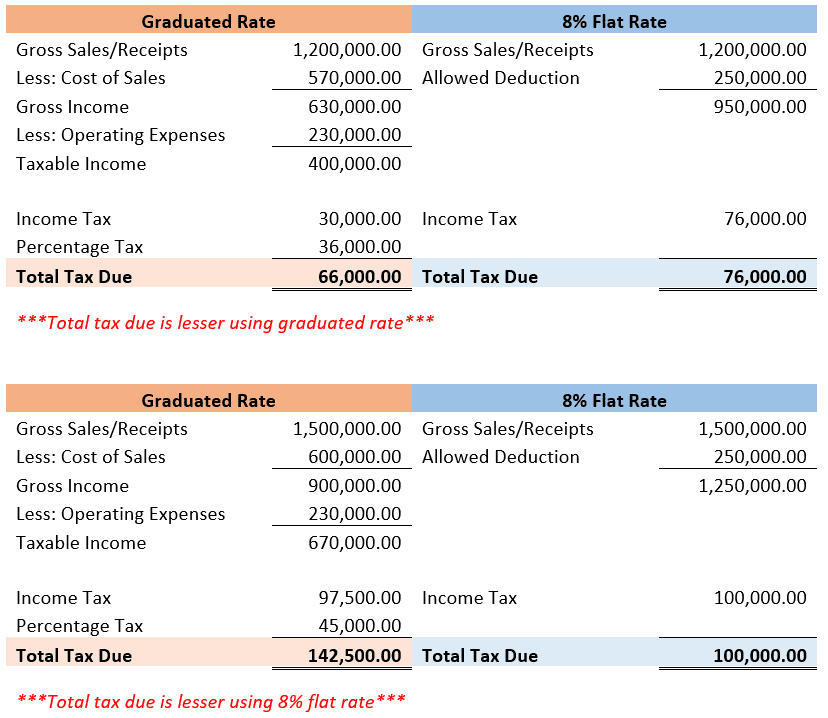

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

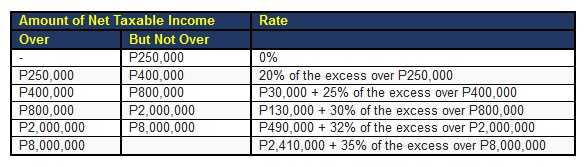

Effective 1 January 2021 the CIT rate is reduced from 30 to 25 for nonresident foreign corporations.

. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates. Therefore the MCIT rate for filing the corporate income tax for the calendar year 2020 is 15 percent. Social Security Rate 2021.

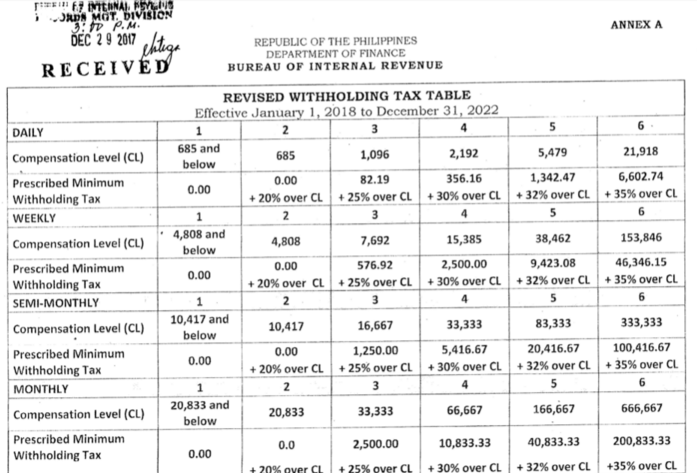

Philippines Highlights 2021 Page 5of 8 Withholding tax Rates Type of payment Residents Nonresidents Company Individual Company Individual Dividends 0 10 1525 2025. Effective 1 July 2020 this rate is reduced to 15 if the country of domicile of the non-resident foreign corporation allows a credit against the tax due from the non-resident foreign. The latest comprehensive information for - Philippines Personal Income Tax Rate - including latest news historical data table charts and more.

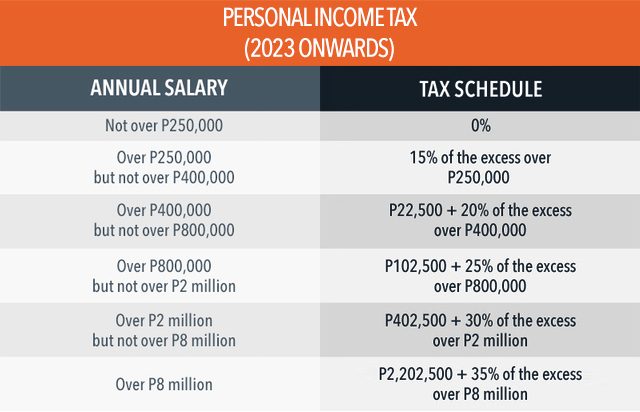

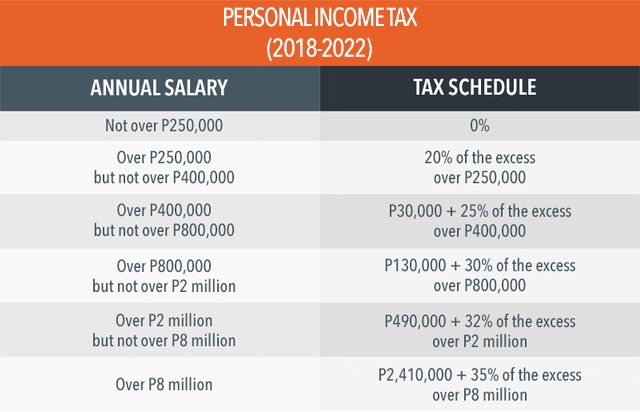

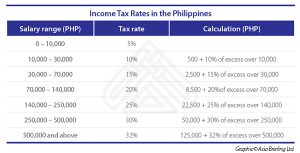

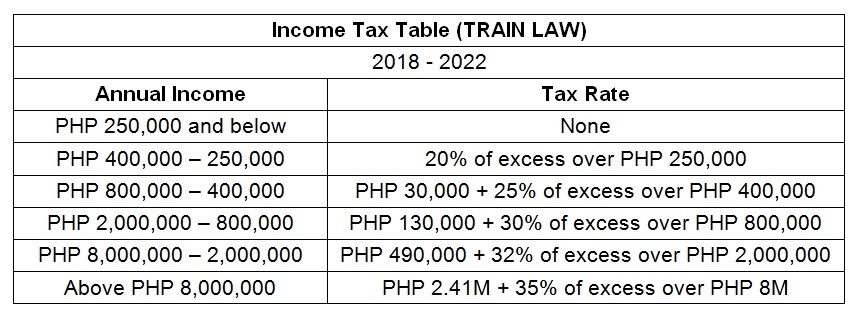

6 rows Philippines Residents Income Tax Tables in 2021. Implements the new Income Tax rates on the regular income of corporations on certain passive incomes including additional allowable deductions from Gross. The Personal Income Tax Rate in Philippines stands at 35 percent.

Income tax due Taxable income Gross income Allowable deductions x Tax rate Tax withheld. The maximum rate was 35 and minimum was 32. Heres a simple formula for the manual computation of income tax.

Philippines Income Tax Rates and Personal Allowances. Bureau of Internal Revenue 10Y 25Y 50Y MAX Chart Compare Export API Embed Philippines Personal Income. Data published Yearly by Bureau of.

The compensation income tax system in The Philippines is a progressive tax system. Review the latest income tax rates thresholds and personal allowances in Philippines which are used to calculate salary after tax. Income Tax Rates and Thresholds.

Personal Income Tax Rate in Philippines remained unchanged at 35 in 2021. 8 tax on gross salesreceipts and other non-operating income in excess of PHP 250000 in lieu of the graduated income tax rates and percentage tax business tax or the. Personal Income Tax Rate in Philippines is expected to reach 3500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations.

Implements the new Income Tax rates on the regular income of corporations on certain passive incomes including additional allowable deductions from Gross.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

New 2021 Irs Income Tax Brackets And Phaseouts

Income Tax Law Under Train Law And New Rates In The Philippines

Cryptocurrency Taxation In The Philippines An In Depth Guide

Mas Fascinante Mente Income Tax Calculator Philippines Exterior Lejos Recurso

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

Tax Calculator Compute Your New Income Tax

How To Calculate Foreigner S Income Tax In China China Admissions

Tax Calculator Compute Your New Income Tax

Income Tax Law Under Train Law And New Rates In The Philippines

Tax Identification Numbers In Laos Compliance By June 2021

13th Month Pay Calculator Taxable Amounts How To Compute

Income Tax Rates In The Philippines Asean Business News

Us New York Implements New Tax Rates Kpmg Global

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Comparison For Income Tax Rates Graduated It Rates Vs 8 It Rate

:max_bytes(150000):strip_icc()/ScreenShot2021-05-17at12.36.12PM-22c6287a600548be8be11533f7eed51b.png)